Retirement Coach Greg Taylor Sheds Light On The Financial Risks You Could Be Taking

Am I Taking Too Much Risk?

Retirement Coach Greg Taylor sheds light on the financial risks you could be taking, and are unaware of.

Dublin, OH. – Retirees and those soon to be retired are struggling to figure out what amount of risk is really acceptable for them in these turbulent economic times. Plus, the whole idea of diversification and risk management are proving to be more complex than originally thought. If these are questions you have been struggling with, then Greg Taylor may provide you with some simple straightforward guidance on how to navigate these tricky economic times.

“Financial loss associated with taking risk is often overlooked by folks who are exposed to financial markets,” said Greg Taylor, Founder and CEO of Legacy Retirement Group, LLC.

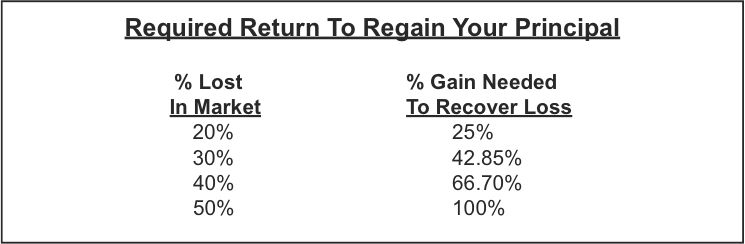

Let’s start with “the math” and explain the realities of loss.

“As you can see, it takes MORE gain to recover from a loss than the original loss itself,” said Taylor. “This seems illogical, so let’s walk through a simple illustration:

If you have $100,000 invested into a mutual fund and that fund experiences a 20% loss, the resulting value on your next statement from the mutual fund company will show an account value of $80,000.

So, will a 20% gain get you back to even? No. Let’s crunch the numbers:

$80,000 x 20% = $16,000

$80,000 + $16,000 gain = $96,000 ($4,000 LESS than your original investment)

As we get older, our time horizon gets less tolerant to market losses due to the amount of time it may take to get a significant double-digit return just to get back our own money.”

The best defense to market losses is often thought to be proper asset allocation and diversification.

“I agree that risk can be mitigated by where you put your money, but, often, diversification is done by buying multiple funds all exposed to the same market risk and really providing little cushion to the economic risks associated with investing in the market,” said Taylor.

An old formula, with a new twist, may provide a greater level of safety. The old rule of thumb was simply allocate your age to safe savings vehicles like CDs, bank accounts and find insurance company products like cash value life insurance and/or annuities.

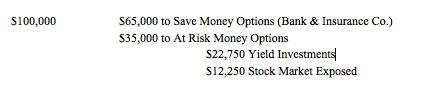

As an example, a 65-year old couple using this formula would put 65% of their money into these safe vehicles and allocate only 35% of their assets to risk. So, the risk assets are calculated by taking 100 minus your age.

The new twist is what to do with the 35% you allocate to risk-based retirement funds. Based on new findings, like those recently published by the Putnam Institute, about how much money should be at risk in the stock market, they concluded (as reported in MarketWatch July 11, 2011 article: Retirees Need Less Stocks, More Annuities) “Retirees should invest just 5% to 25% of their portfolio in stocks, or at least that’s the case for those whose primary goal is to minimize the risk of running out of money and sustaining their withdrawals.”

A possible way to build even greater security into your retirement planning would be to only put into stocks and stock mutual funds 100 minus your age. If you add this to the tried and true safety formula, the math on a $100,000 account for a 65-year old would look like this:

This formula appears to conform to the new research suggesting the reduction of overall market risk when future retirement income is the ultimate goal of your retirement planning.

For more information on this topic, or to learn how Greg Taylor can help, please visit www.legacyretirementgroup.com.

For media inquiries only, please contact Jenn Horner at [email protected].

About Greg Taylor:

Greg Taylor is commonly referred to as the “retirement coach,” and has been serving and educating retirees for over a quarter of a century. In 1994, he founded Legacy Retirement Group, LLC in Dublin, Ohio.

Taylor is a member of many distinguished industry organizations. He was recently named, ‘Advisor of the Year’ by a national industry organization for his commitment to client education and perseverance in reaching out and assisting Ohio’s community with retirement planning issues.

As a veteran of the financial services industry, Taylor has the knowledge and expertise to help retirees and those transitioning into retirement develop a comprehensive plan to protect against taxation, inflation, long term illness and probate. Taylor attributes his success as a Financial Advisor to his passion for helping others, his pursuit of providing financial security in the golden years and his commitment to client satisfaction.

Taylor has several exciting initiatives in the works, including Web site revisions and staff additions, but the crowning jewel is his upcoming book, “Winning Retirement”, set to release August 31, 2012.